Share and Follow

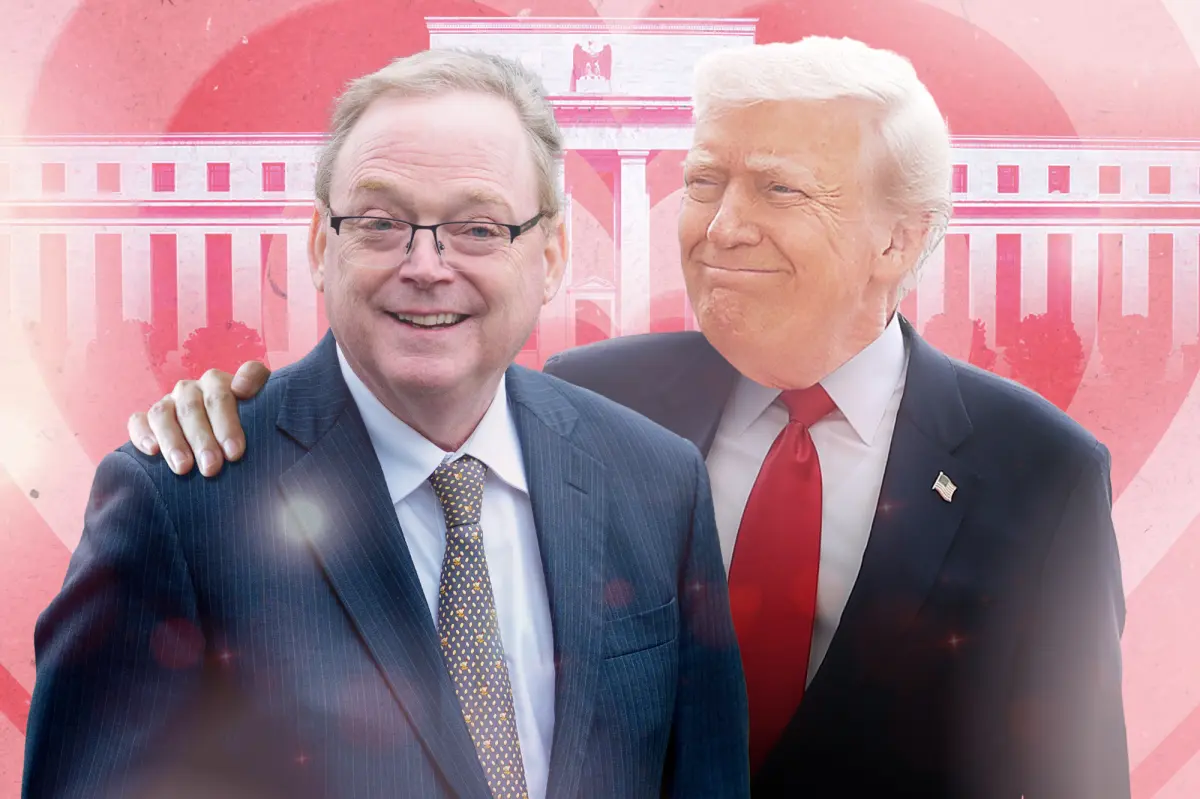

Kevin Hassett continues to be the leading candidate to replace Jerome Powell as the Federal Reserve Chairman, even though there are significant concerns from Wall Street and business leaders.

“The decision ultimately lies with the president,” explained an insider familiar with the nomination process for the next Federal Reserve leader.

This week, President Trump initiated meetings with potential candidates as he narrows down his choice for the Fed chair position. Earlier, he met with Kevin Warsh, a former Federal Reserve governor and current Stanford academic. Other candidates might also find themselves in similar discussions at the Oval Office.

However, the corporate world, keenly observing Trump’s selection due to its implications, views these meetings as more symbolic than practical.

Among corporate executives and CEOs I have spoken with, Hassett emerges as the clear front-runner, primarily because President Trump is focused on reducing short-term interest rates. Although the current chairman has implemented slight cuts, Trump desires more significant reductions. Hassett is perceived as someone who will aggressively support Trump’s economic objectives.

“He does it three times a day,” is how one CEO described Hassett’s cheerleading of MAGA economics as he vies for a job that is supposed to be independent from the White House.

The Fed, of course, was created by Congress to be semi-independent of the White House and politics. The president chooses the chairman subject to senate confirmation, but the term lasts four years and he can only be dismissed for “cause” like doing something illegal, or Powell would be out of there by now because he has resisted Trump’s efforts for him to cut short term interest rates more and faster.

The Fed is also known for its “dual mandate.” It conducts what’s known as monetary policy by increasing or decreasing the money supply through various measures including adjustments of short-term interest rates to achieve what’s known as “price stability.” The other part of the mandate involves creating as much employment that’s possible before the economy overheats and causes inflation.

It’s not an easy balancing and it often puts the Fed and the chairman who sets the policy tone at odds with the White House as Powell has been with Trump.

The betting is Trump won’t have that issue with Hassett, currently his director of the National Economic Council. Hassett has been reliable tout of MAGA policies such as tariffs, which some say has contributed to the sticky inflation that has led to the so-called affordability crisis, and ways Trump has sought to band-aid the situation by delivering tariff bonuses to many Americans or subsidies to farmers hurt in the trade war.

Here’s why CEO and market types are worried about making him Fed chair: He could literally spook the bond market if traders are convinced he will keep printing money and do stuff that aid Trump’s economic plans such as massive cuts in short term rates, and ignore inflation.

That could lead to investors demanding higher rates to buy our debt, and when that happens — spiking yields on the 10-year and 30-year bonds — not only do we pay more to finance the budget deficit, it will likely lead to an economic slowdown.

As I reported, CEOs have warned the White House that a Hassett nomination could disrupt the bond markets, and presumably that’s why Trump has held those meetings earlier in the week to show he’s triple-checking his gut on his choice to replace Powell when he retires next year.

But Trump isn’t easily swayed, and he likes what Hassett brings to the table. He’s TV ready (a big presence on my employer Fox News explaining MAGA economics) and has an accomplished resume. He holds a PhD in economics from the University of Pennsylvania and has served time in think tanks and at the Fed as an economist.

Yes he checks a lot of boxes including the one that really matters: He’s a Trump loyalist, which is why the betting markets have him as the favorite.

Could Trump surprise us all? Maybe. If he does, Wall Street will be cheering.