Share and Follow

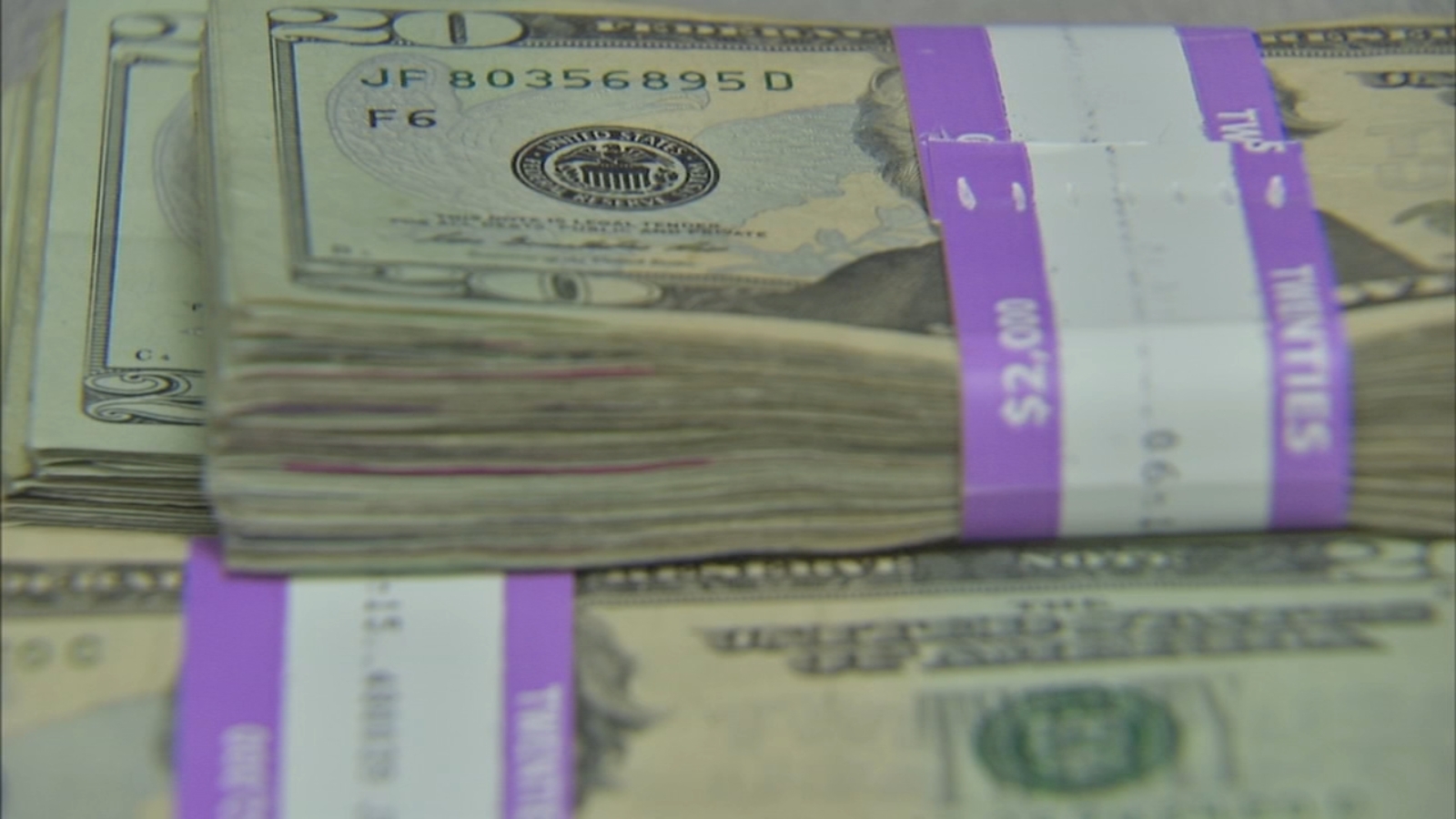

LOMBARD, Ill. (WLS) — A local man says he couldn’t access tens of thousands of dollars, when his Chase Bank account was suddenly frozen.

Frustrated with the lack of resolution, he turned to the ABC7 Chicago I-Team for assistance in unraveling the situation.

ABC7 Chicago is now streaming 24/7. Click here to watch

The local man says, for more than a month, he couldn’t access his own money: $42,000 were frozen.

Throughout this period, he faced numerous delays and received vague responses from the bank, compounding his frustration.

Jim Gibson, a resident of the western suburb of Lombard, was taken aback when Chase locked him out of his account without warning, depriving him of the money he needed to manage bills and daily expenses.

“I opened my Chase account on July 7 of this year. I regret that decision greatly,” Gibson said.

Gibson says the mysterious freeze happened at the end of July, shortly after he took out a large sum of money.

“I got an email from Chase informing me that my account had been suspended with no explanation as to why, and it was directing me to go to the local Chase branch,” Gibson said.

Gibson says the teller told him Chase restricted his account “To help protect against fraud.” He says he never got a further explanation, but was told he’d receive the money in his account within 10 days.

“I had $42,000 sitting in that Chase account, which is not a small sum,” Gibson said.

SEE ALSO: Some of thousands who experienced ‘frozen funds’ through high-yield savings app getting refunds

Gibson says, weeks later, that check still hadn’t come. Bills were mounting up, and he panicked.

The I-Team contacted Chase, and Gibson quickly got his money.

“I was living off of a credit card. It was extremely stressful and totally unnecessary. And I’m extremely grateful to you, Jason, for intervening, breaking the logjam. And I’ve got my money, and I’ve restored all my auto debits,” Gibson said.

In a statement to the I-Team, Chase says:

“To help protect against fraud, we restricted Mr. Gibson’s account. After additional review and communication, we released the funds and regret the delay in that process. For privacy and security reasons, that’s all the information we can disclose.”

Gibson says he was not a victim of fraud when he took that money out. However, banks can freeze and restrict accounts if they believe you’re a victim or if you’re mysteriously withdrawing large sums of money.

It’s all to protect customers, but Gibson calls it a huge hassle.

“Yeah, it was an absolute living nightmare daily,” Gibson said.

To avoid getting an account frozen for fraud, notify banks before making a large transaction.

Customers can explain the withdrawal to a teller. So, they don’t think they’re victims of an ongoing romance or confidence scam.