Share and Follow

LYONS TOWNSHIP, Ill. (WLS) — It is money homeowners are owed but never received.

The I-Team investigated complaints about delayed property tax refunds and disputes in one Cook County township.

ABC7 Chicago is now streaming 24/7. Click here to watch

They are called certificates of error. They are supposed to help property owners correct mistakes in their assessments and get refunds when they’re overcharged. But the I-Team found several cases in which homeowners say red tape or disputes have delayed their refunds.

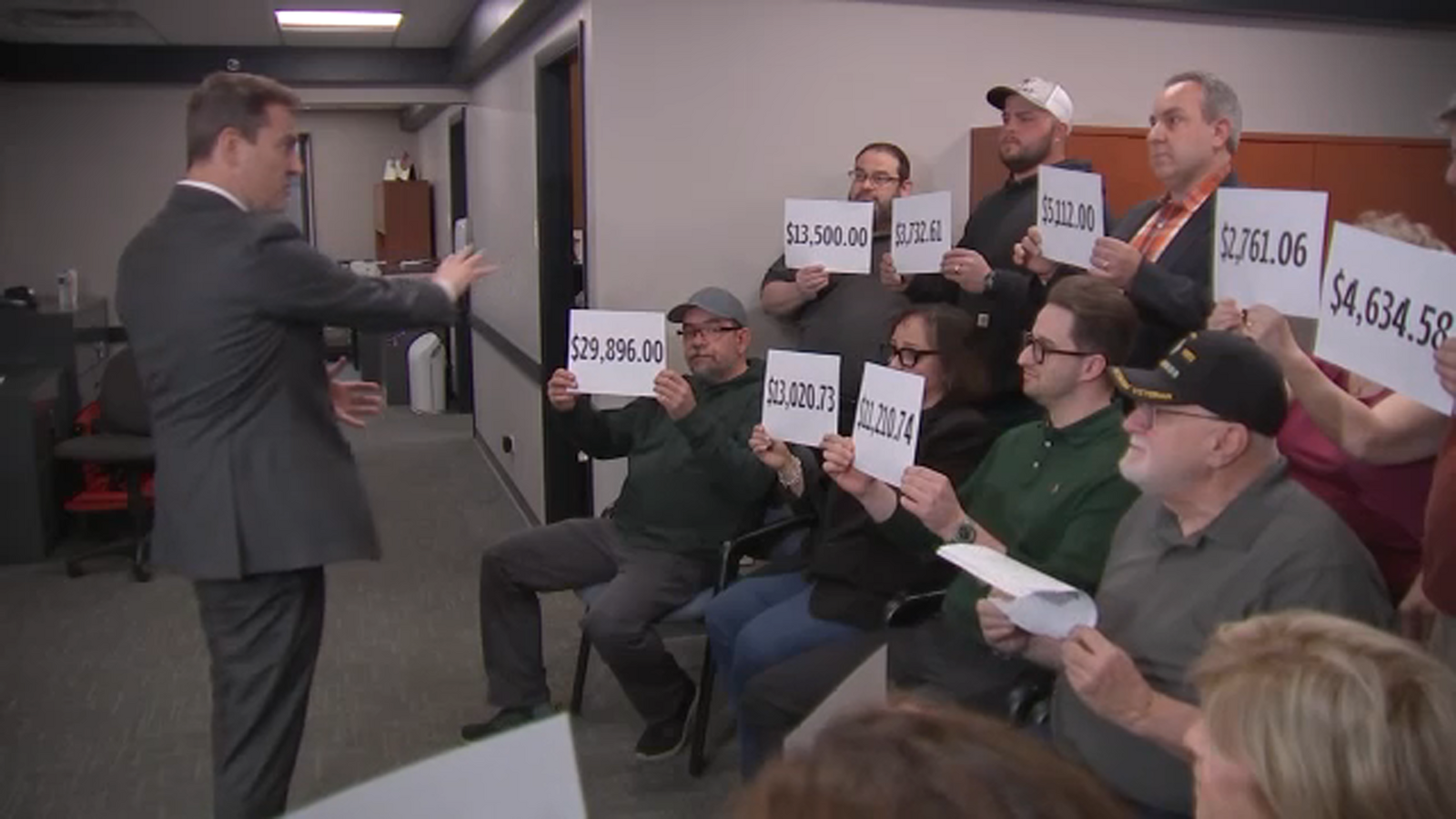

Eleven Lyons Township homeowners held up signs of how much money they say Cook County owes each of them. It is money ranging from about $2,700 to about $29,000.

They say they are owed that money because of errors in their assessments by the Cook County Assessor’s Office, errors they say resulted in them being overcharged on property tax bills.

The group wants answers from Cook County Assessor Fritz Kaegi. They all met with ABC7’s Jason Knowles in the office of the Lyons Township Assessor’s Office. Township assessors help residents prove errors to the county.

The Cook County Assessor’s Office has corrected the issues for current and future tax years, but these homeowners say they have been waiting on answers or, in many cases, waiting on the certification of “certificates of error” for the previous years in question. But Janet Edmonds, who says she is owed $23,193.62, was initially denied.

SEE ALSO | Likely Cook County property tax bill delay spurs blame game between politicians, contractor

“Because I paid overpaid in taxes to Cook County for a home that was just a piece of property that nobody was living in,” Edmonds said. “And there was no home.”

Edmonds says she overpaid three years of property taxes because she was getting billed as if there was livable home on the property, but she had purchased a home that was destroyed by a fire.

“I since then knocked that home down a few years later and built a new home on that property. But I was being charged all that time as if I was living there in the home, which was not livable,” Edmonds said.

The Cook County Assessor’s Office said her original appeal included pictures and articles about the fire but not an affidavit or fire report. The county says a recent second appeal with more details was approved. Edmonds will be granted the certificates of error for two of the three years. She missed the appeal window for 2019.

Chanda Davidson, who says she is owed a little over $11,000 is waiting on a previous certificate of error to be certified on a square footage error.

“It’s a lot. We could definitely use it,” Davidson said. “So, it was about 700 square footage over what our actual property was, which makes a big difference over time.”

READ MORE | Cook County Treasurer Pappas’ study shows shift in property tax burden from businesses to homeowners

Omero Morales says his taxes also doubled when the assessor was counting his remodeled garage as living space. He says he is waiting for certificates of error to be certified, to get a refund of more than $4,600.

“My house doubled in size because they thought the garage was actually part of the house,” Morales said. “I could use it for my kids’ education. I could use it for myself.”

The ABC7 I-Team supplied the Cook County Assessor’s Office with details on all 11 cases. The chief communications officer, Angelina Romero, responded to the I-Team’s questions.

“We’re working to get these processed and approved,” Romero said.

The Cook County Assessor’s Office says the certificate of error process involves multiple steps within their office and between different offices in the property tax system, like the Cook County Board of Review, the Cook County Treasurer’s Office, and the Cook County Clerk’s Office. The process could also include in-person field inspections for many cases.

“Yeah, definitely. It’s frustrating. I myself, as a homeowner, I definitely empathize with these homeowners and understand these are people’s livelihoods. These are their houses,” Romero said.

But some delays may continue due to a countywide technology upgrade.

“But you want to pay what what’s right. I shouldn’t have to fight for years to get a reimbursement,” Edmonds said.

Now, the processing of certificates of error is on hold. That means people in this situation will not be issued refunds until the upgrade is complete.

Copyright © 2025 WLS-TV. All Rights Reserved.