Share and Follow

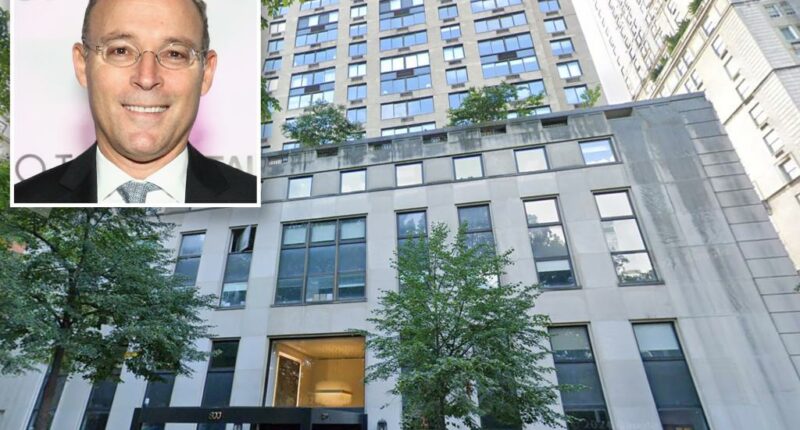

Two monumental transactions last week, both facilitated by the renowned Newmark team, have invigorated the city’s investment-sale markets. Insiders shared that Miki Naftali’s $810 million acquisition of the rental apartment tower at 800 Fifth Ave. was more influential for the luxury residential sector than the $1.08 billion transaction for 590 Madison Ave. was for the commercial sector.

“That represents record pricing for a building of its size — 33 stories,” remarked an industry source regarding 800 Fifth Ave. “Moreover, it might be the prime Manhattan location for an ultra-luxurious condo development. Honestly, can you surpass Fifth Avenue and East 61st Street?”

Naftali intends to dismantle the current building to make way for an alluring new condo tower. “We’re ecstatic that after fifty years as the premier rental building in the city, 800 Fifth will evolve into the next premier condominium,” he expressed in a statement.

That could require evicting or relocating tenants of 208 apartments. Sources said the mood in the building was subdued but not panicked as Naftali’s move came as no surprise. Some tenants “hired lawyers months ago,” we’re told.

A Naftali Group spokesperson would only say, “We look forward to sharing our vision for the contextual redevelopment of this site with the community in the coming months.”

The 1978 building was developed by Bernard Spitzer, the late father of former Gov. Eliot Spitzer, and was owned prior to the sale by Spitzer Enterprises and Winter Properties.

Meanwhile, Scott Rechler’s RXR closed on the $1.08 billion purchase of 1 million square-foot 590 Madison Ave. at East 57th Street, the former IBM Building. It was less than pension fund STRS Ohio’s $1.1 billion asking price, but the first $1 billion-plus purchase of an office tower by a real estate company since before the pandemic. (Alphabet occupied the St. John’s Terminal building before it bought it for $2 billion in 2022).

RXR’s price was also much less than the $1.3 billion that STRS hoped for when it tested the market back in 2018.

One source termed the deal a “distress” sale, a characterization supported by RXR itself. In a statement, it credited its “Office Recovery Strategy” which targets “trophy office properties that can be acquired at significant discounts to peak valuation.”

The tower managed by Edward J. Minskoff Equities took a hit when IBM left for SL Green’s One Madison two years ago. But it rebounded with a $100 million capital upgrade and rode the wave of demand for trophy-quality midtown addresses. A recent 100,000 square-foot lease with Apollo Global Management lifted 590 Madison’s office occupancy to 87%.

A question mark is the future of the highly visible Bonhams space on the tower’s Madison Avenue side. When the auction house moves to 111 W. 57th St. next year, as we first reported, it will leave behind nearly 28,000 square feet of precious retail space, now on the market through Cushman & Wakefield.

One insider said, “In today’s hot market for luxury retail, a vacancy like this is more of an asset than a liability.”

A Newmark team led by Douglas Harmon and Adam Spies brokered the 800 Fifth Ave. sale for the sellers. Harmon and Spies also acted as equity capital advisors to RXR and its partner Elliott Investment Management in their purchase of 590 Madison Ave.