Share and Follow

A strange investment blunder might have cost the United Auto Workers union a colossal $80 million, according to a report on Monday.

In August 2023, the union’s board decided to sell around $340 million in stock investments to provide funds for striking workers the following month. They also instructed that the remaining money should be reinvested promptly once the strikes were over.

The strikes concluded in October 2023 after lasting only a month. However, even more than a year later, the funds had not yet been reinvested, as stated by UAW officials, union workers, and documents examined by Reuters.

An analysis conducted by union staff in February suggested that if the money from the stock sale had been reinvested quickly, the UAW, representing 400,000 workers including those at General Motors, Ford, and Stellantis, could have potentially gained an extra $80 million.

The UAW did not immediately respond to The Post’s request for comment.

Board members grew suspicious late last year and started questioning why the union’s return on its portfolio seemed so small compared to overall gains in the stock market, according to documents and five sources familiar with the matter.

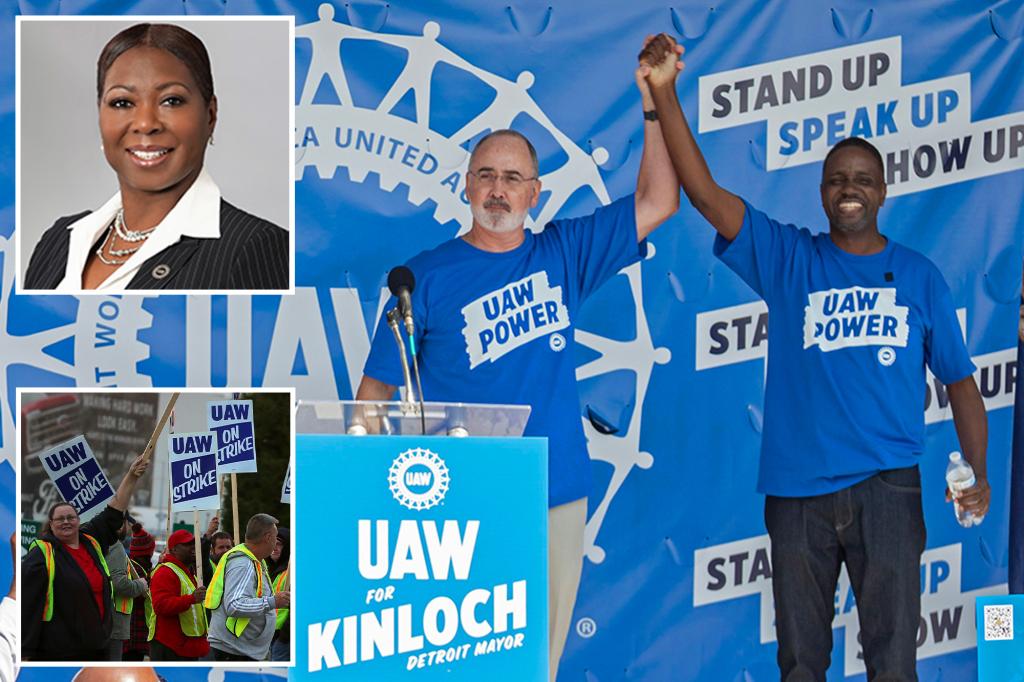

At one meeting, UAW President Shawn Fain asked why he could get higher gains in a bank account than the UAW was reaping, according to four people present at the gathering.

It turned out that the union’s strike fund had been used to pay workers $500 a week, but rather than investing the remainder in stocks, it was placed in a mix of cash, fixed-income and alternative assets in September 2024, according to documents viewed by Reuters.

Union staffers presented the $80 million figure in February 2025. Their analysis did not include the methodology used to reach that number, though sources said it was based on a comparison of actual results to what the returns would have been in the stock market.

The matter is now being investigated by a federal monitor that was appointed as part of a 2020 settlement between the union and the Department of Justice over a multi-year corruption probe.

Responsibility for UAW’s investments is shared by the union president, secretary-treasurer and its three vice presidents, Michael Nicholson, attorney for Secretary-Treasurer Margaret Mock told Reuters.

“We welcome the monitor’s review regarding investments, because we believe that any accusations against Margaret Mock are unfounded,” he added.

Tensions have been brewing between Mock and Fain, with the latter inappropriately stripping Mock of some of her duties in February 2024 because she wouldn’t authorize certain expenditures related to strike preparations, according to a report by the union’s federal monitor.

The union’s board appears to have taken Fain’s side in the investment snafu, writing in a statement that she’s under investigation by the federal monitor “for a significant compliance failure regarding our union’s investments.”

Segal Marco Advisors worked with the union to manage its $1 billion strike trust, according to documents and sources.

The firm did not immediately respond to The Post’s request for comment.