Share and Follow

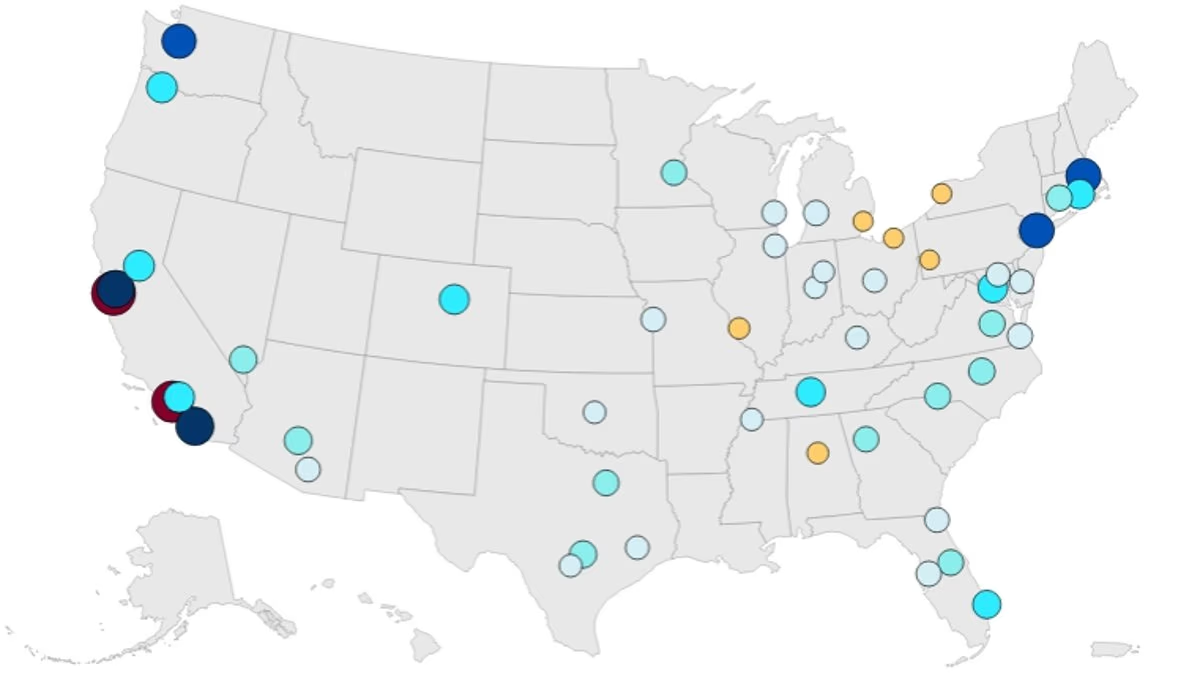

Concerns over the housing market are escalating, as home prices in 26 out of the 50 largest metropolitan areas in the United States have dropped compared to a year ago.

For the first time in almost three years, the median listing price for homes in the U.S. has fallen below the $400,000 mark, a significant threshold that had been consistently maintained during the pandemic-induced housing surge, as reported by Realtor.com.

Although there’s a national average price decline of 0.6 percent, this figure masks more pronounced decreases in various regions across the country.

The most significant decline is in Austin, Texas, where home prices have tumbled by 7.3 percent over the past year, bringing the average price down to $462,000, marking the steepest drop among major metropolitan areas.

The downturn isn’t confined to Texas. In San Diego, California, home prices have decreased by 6.7 percent, now just under $900,000, while in nearby San Jose, values have decreased by 5.5 percent, settling at $1.19 million.

Yet while much of the Sun Belt and West Coast cools, other parts of the country are still heating up.

In the Midwest and Northeast, tight supply continues to push prices higher despite the broader slowdown. Grand Rapids, MI, leads the country, with prices up 5.9 percent over the past year to $397,000.

‘Looking at the housing market through national or even regional averages can miss what’s really happening on the ground,’ said Danielle Hale, chief economist at Realtor.com.

Once one of America’s hottest housing markets, the Austin area has seen prices fall 7.3 percent over the past year — the steepest drop among major US metros

Home values in the San Diego region have dropped 6.7 percent over the past year, as higher borrowing costs cool demand in one of the country’s priciest markets

Danielle Hale, chief economist at Realtor.com.

‘In 2025, some metros closely tracked their regional story, while others followed a very different narrative.

‘Understanding whether your local market is typical or an exception is critical as we head into 2026.’

Sellers across the country have also been forced to cut prices after watching their homes sit on the market for months while stubborn buyers hold all the negotiating power.

In fact, there are only seven seller’s markets remaining in the US.

High supply and low demand has transformed the other 43 markets, leaving them balanced or under the control of house-hunters.

While this may seem like welcome news for frustrated buyers, it is actually a warning sign for the wider economy.

Falling prices make homeowners feel poorer, pull down household spending, drag on confidence, and can trigger deeper trouble in markets already stretched by high mortgage rates and shrinking savings.

For most Americans, their home is their biggest asset. Even a small 1 percent national price dip can erase billions in household wealth.

Home prices in the Grand Rapids area have risen 5.9 percent over the past year, the strongest growth of any major US metro, as tight supply continues to prop up values

Prices in the Providence metro are up 4.8 percent from a year ago, bucking the national slowdown as limited inventory keeps pressure on buyers

The average price of a home in the US has dropped below $400,000 for the first time since March 2022 (Pictured: homes in Nashville)

When home values fall, people pull back. In 2008, sinking prices led to a sharp drop in consumer spending — a reminder that a soft market can slow the whole economy.

When prices flatten or fall, banks get cautious. That can mean tougher approvals and fewer options, even for first-time buyers.

Recent buyers face negative-equity risk: anyone who bought near the late-pandemic peak could end up owing more than their home is worth if prices slip.

And when housing weakens, the job market often weakens too. Construction slows, people spend less on renovations, and sellers who need to move for work may struggle to do so.