Share and Follow

The war is over: not the war in Ukraine or Gaza – I mean the war on inflation.

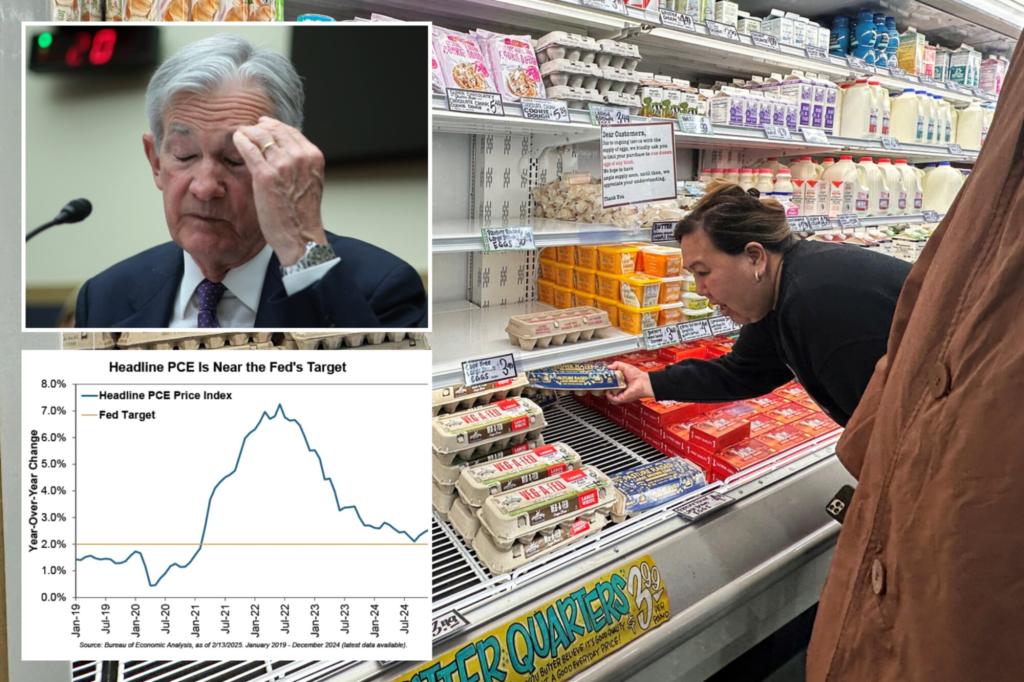

Shoppers remain highly concerned while shopping at the grocery store, recently becoming anxious over the prices of eggs. Simultaneously, economists, politicians, and commentators are continuously monitoring categories of goods and services and the increase in wages, especially in light of the recent acceleration of the Consumer Price Index in January.

They are all fighting the last war. How about you and your stock portfolio?

Inflation has undeniably impacted households significantly since 2021, causing distressing situations for many individuals. By the end of January, the Consumer Price Index showed a 23.4% rise compared to December 2019, although this figure does not fully capture the actual experiences of many shoppers, likely including your own. Unfortunately, the conclusion of a military conflict does not signify an immediate reversal of the damage incurred.

Regrettably, the same pattern is observed with inflation. It is important to differentiate between prices and inflation, as they represent distinct concepts. Inflation pertains to the rate at which prices are escalating, currently standing at 3% compared to a year ago as per the Consumer Price Index. Although certain categories of prices may decrease, overall prices do not exhibit a downward trend. It is highly uncommon for developed nations to experience broad price decreases, commonly referred to as deflation.

Real, deep deflation means depression – an even deadlier war. Reversing CPI’s post-pandemic rise means approximating 1929 – 1933’s deflation or the early 1920s’ post-World War I downturn. Is that really what you want? Didn’t think so. Winning the inflation war was never about lowering prices, but rather slowing their advance.

Last November, I detailed the reasons the Federal Reserve wants 2% ongoing annual inflation. Since peaking at 9.1% in June 2022, CPI irregularly cooled to January’s 3.0%. Despite all the yakking about acceleration, that’s 0.1% above December. A statistical blip. These measures aren’t that exact anyway.

Meanwhile, December’s “personal consumption expenditures price index,” the broader gauge the Fed actually targets, was 2.6% versus a year ago. Pundits shrieked that it was “stuck” above the 2% target, hyping every worrisome wiggle. But no evidence exists – none, zero, zip – that the Fed can fine-tune anything precisely.

Weirdly, “stubborn shelter” inflates CPI. But it’s mostly from the fictitious “owner’s equivalent rent” calculation – what goofball government statisticians guesstimate homeowners would pay to rent their own homes. No one pays this.

Excluding shelter, December CPI was 1.9% versus last year —including bird-flu-spiked eggs. The Fed doesn’t want it much lower. So, don’t expect it. But the “war” is over.

Inflation is simply a case of too much money chasing too few goods and services. It comes with a time lag – money supply growth rate exceeding GDP growth rate – and it’s always caused by the Fed, which never, ever takes responsibility.

During 2020’s COVID chaos, the Fed stupidly, bizarrely ballooned money supply. M4, the broadest gauge, soared 30.9% year over year in June 2020. M2, narrower, hit 26.6% in February 2021. Later, prices galloped.

The Fed has slowed down, now growing the money supply at 3.4% and 3.9%, respectively – below most years since the 1980s. Subtract from them about 2% annual GDP growth and you will see inflation ahead below 2%.

Worried about wage growth? I detailed last August exactly why it isn’t ever inflationary and can’t ever be. I won’t rehash that now – it was a whole long column, you can look it up. But economists, politicos and pundits seemingly never, ever learn.

How about President Trump’s tariffs? Again, the key here is that tariffs don’t affect money supply. Tariffs can make some prices rise – although far less and smaller than most think. Mainly, tariffs boost some prices while forcing others to fall. Tariffs channel demand, creating winners and losers.

Yes, tariffs are poor economic policy. But inflation isn’t why. Think of all that inflation we didn’t get with Trump’s first term tariffs.

So what’s the underappreciated, non-inflated truth for investors? Hate to burst some bubbles here, but market forecasting requires seeing something big that others don’t. Huffing and puffing about inflation alongside an army of “experts” won’t help.

The inflation war is over, full stop. Be bullish.

Ken Fisher is the founder and executive chairman of Fisher Investments, a four-time New York Times bestselling author, and regular columnist in 21 countries globally.