Share and Follow

With property taxes rising sharply across Florida, the state’s GOP is calling on local governments to roll back their rates to “provide immediate relief.”

TALLAHASSEE, Fla. — With property taxes rising sharply across Florida, the state’s Republican Party is calling on local governments to roll back their rate in an effort to provide immediate relief to homeowners.

The new campaign, dubbed “Rollback Now,” urges local leaders to lower the tax burden and/or adhere to the rollback rate — listed on annual Truth in Millage (TRIM) notices — that generates the same amount of revenue for local governments despite rising property values.

“I think the number one issue facing Floridians right now is affordability and housing. A big piece of that is property taxes,” Florida GOP Chairman Evan Power said. “60% increase in property tax over the last five years is really unsustainable for homeowners.”

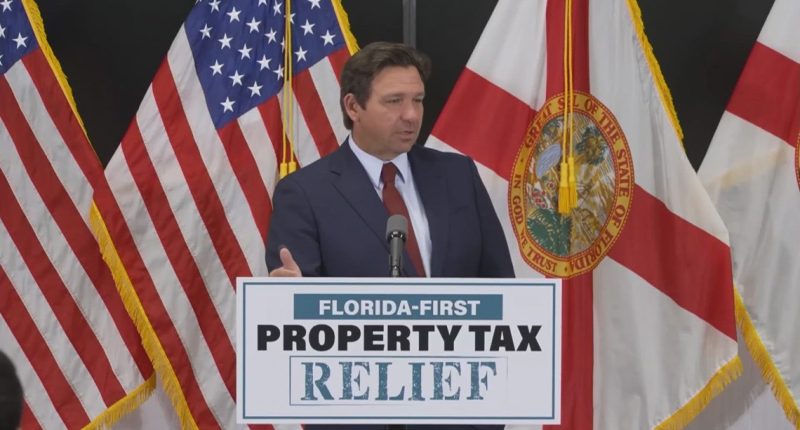

Power emphasized that while Governor Ron DeSantis and state lawmakers have proposed reforms — and even an outright elimination of property taxes — those changes wouldn’t take effect until at least 2027, needing a constitutional amendment to be weighed in on by voters statewide.

“Homeowners need tax relief now,” Power said. “We’re going to ask for our local parties to put pressure on their local leaders.”

The party is urging voters to sign a petition, and they’ll be tracking responses from local government officials over the coming weeks.

Florida tax relief debate

At the state level, discussions around tax relief have been marked by tension.

DeSantis’ proposal for a property tax rebate failed to gain traction during the legislative session. Meanwhile, House Speaker Daniel Perez created a special committee to study long-term property tax reform options — a move the governor criticized during remarks Tuesday in Miami.

“This is a total dog and pony show. This is not anything that is credible,” DeSantis said. “The fact that you’d wait until the last day of the legislative session, it shows your cards.”

While a long-term overhaul, possibly including a constitutional amendment on the 2026 ballot, remains in discussion, lawmakers may pursue short-term tax breaks, such as a cut to the sales tax or additional tax holidays as part of ongoing budget negotiations.

Lawmakers continue budget talks next week in Tallahassee.

A ‘risky proposition’

While some are applauding the governor’s support of a potential constitutional amendment to abolish property taxes, a report from state think tank Florida Policy Institute calls it a “risky proposition,” that could weaken local governments.

Data cited shows policymakers would need to make up for a $43 billion hole to maintain the current level of services the taxes help pay for at the city and county level.

“Florida’s tax on real property, which makes up 18 percent of county revenue, 17 percent of municipal revenue, and 50 to 60 percent of school district revenue is — effectively — the domain of local governments. The real property tax strengthens their ability to address local needs, including fire and police services, education, and safety net programs,” the report by Esteban Leonardo Santis, PhD, reads.