Share and Follow

A defiant President Trump showed no sign of backing away from his sweeping tariff plans early Monday — even as stock index futures tumbled.

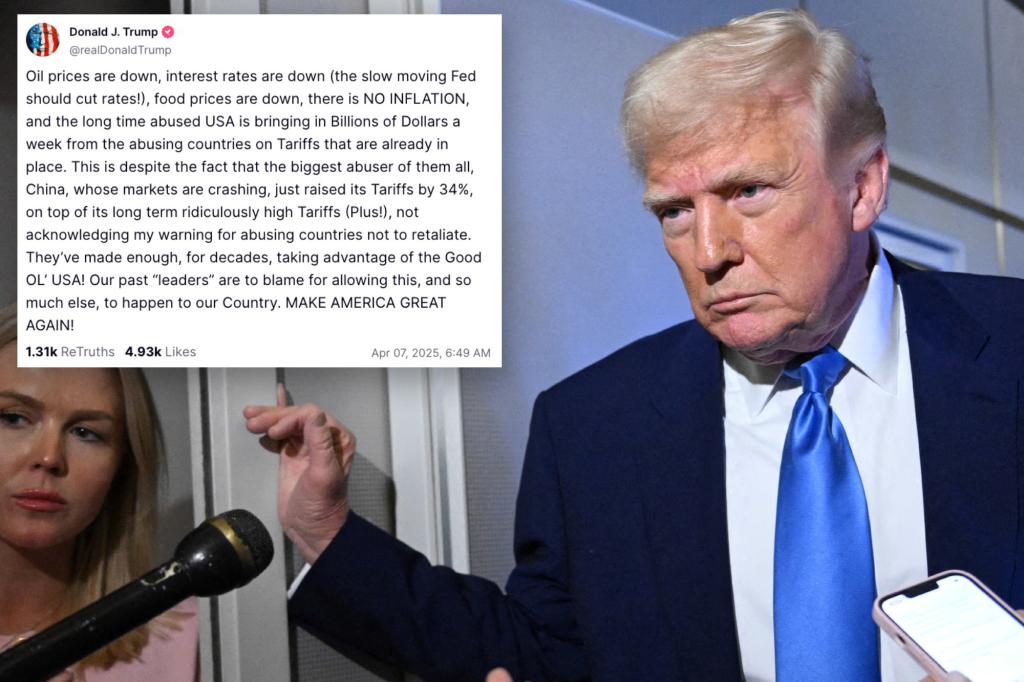

In a recent post on Truth Social, it was highlighted that several economic factors are currently in a favorable state. Oil prices, interest rates, and food prices have decreased. The absence of inflation was also noted, along with the significant revenue being generated by the United States through tariffs imposed on other countries.

The commander in chief also ripped China after Beijing struck back against Trump’s far-reaching “Liberation Day” with its own 34% levy last week.

A specific call was made for the Federal Reserve to reduce interest rates promptly. Attention was drawn to China as a major player in the current economic landscape, despite its own markets experiencing a decline. Furthermore, criticism was directed towards China for increasing tariffs by 34%, on top of existing high tariffs, despite warnings against such actions.

The sentiment expressed emphasized the historical exploitation of the United States by various countries, with China singled out as a primary offender. The blame was placed on past leaders for allowing such practices to persist, and a call to action was made to restore the greatness of America.

It came as S&P 500 and Dow futures plunged more than 20% from their peak on Monday.

In the two sessions after Trump’s tariff decision, the S&P 500 has tumbled 10.5%, erasing nearly $5 trillion in market value, marking its most significant two-day loss since March 2020.

Meanwhile, Trump told reporters late on Sunday that investors must endure the consequences and that he would refrain from negotiating with China until the US trade deficit is addressed.