Share and Follow

Two billionaire Wall Street titans have squared off in a high-stakes war over the future of Bitcoin.

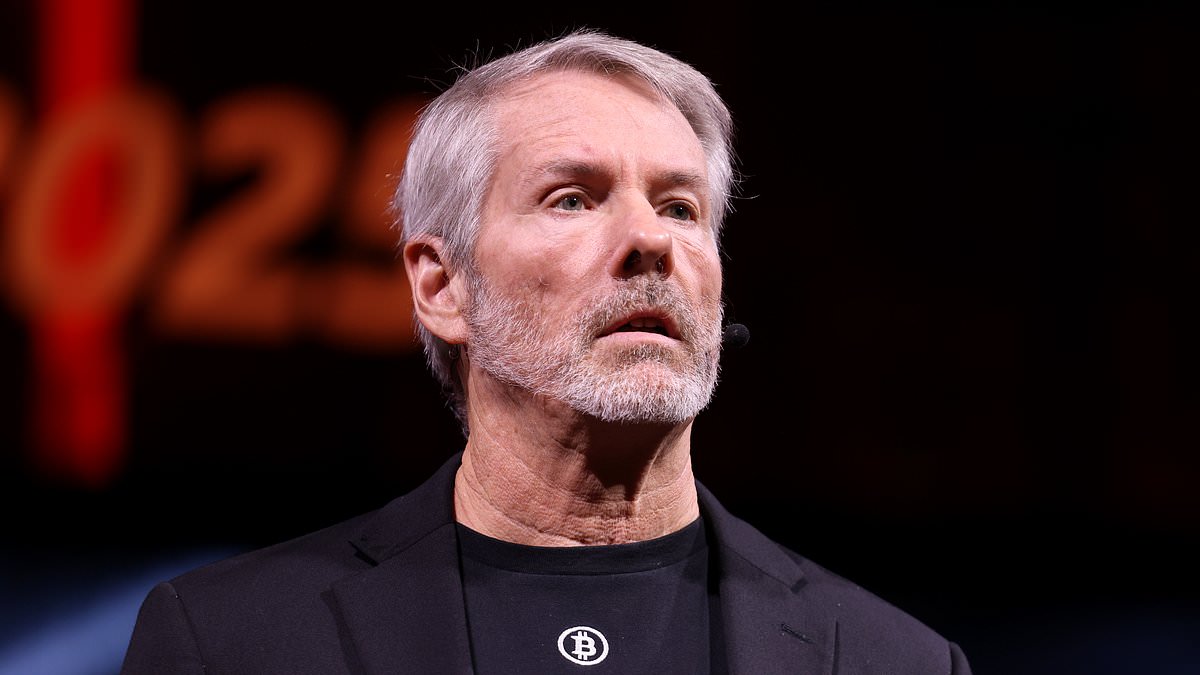

The ongoing clash between Michael Saylor, a cryptocurrency investor, and James Chanos, a renowned financial skeptic, has caused ripples in the stock market.

Saylor, who serves as the executive chairman of MicroStrategy, has spent the last five years accumulating a substantial reserve of over 500,000 Bitcoins, which he describes as a ‘treasury’ of the cryptocurrency, according to a report by the Washington Post.

Through the issuance of stock and bonds, Saylor’s company procured the currency, leading to significant profits for the investor, whose wealth has surged following the election of Donald Trump.

But Chanos, a legendary Wall Street player known for betting against other companies, has gambled against Saylor’s investments in a feud that could spark chaos for investors.

Stocks in Saylor’s company have risen an astronomic 1,500 percent since 2020, and his ‘treasury’ of Bitcoin is currently valued at almost double that of Bitcoin itself.

The massive surge in price could have an impact on wallets across the country, as MicroStrategy is expected to join the S&P 500 – and many 401ks – at some point this year.

Cryptocurrency investor Michael Saylor (pictured) has squared off with billionaire financial skeptic James Chanos over his huge stockpile of over 500,000 bitcoins, what he refers to as a ‘treasury’

Chanos, a legendary Wall Street player known for betting against other companies, has gambled against Saylor’s investments in a feud that has become a public tit-for-tat between the billionaires

Chanos announced at the Sohn Investment Conference in May that he was ‘selling MicroStrategy stock and buying Bitcoin,’ alleging in a subsequent CNBC interview that Saylor’s ‘treasury’ is ‘ridiculously’ overvalued so he was shorting his firm.

Chanos described his play of buying Bitcoin and shorting Saylor’s company as the equivalent of buying something for $1 and selling it for $2.50.

Jim Osman, founder of financial analysis firm Edge, told the Washington Post that the battle between the two titans has gripped traders on Wall Street, and is seen by many as a litmus test for the strength of the cryptocurrency industry at large.

‘It’s a poker game with very high stakes,’ he said.

‘One man has put everything on Bitcoin, predicting that it’s the future of money. And the other man is saying it’s all smoke and mirrors and that he is blinding you with science.’

Osman said the clash comes down to one fundamental question: ‘Do you want to bet on a dream, or do you want to bet against it?’

Saylor’s stockpile of over 500,000 Bitcoin is valued at around $59 billion.

He’s so fond of the cryptocurrency that he shares AI images of himself posing as action heroes such as ‘Bitcoin superman’

Chanos has long been a skeptic of cryptocurrency, and in 2018 he described it as a ‘libertarian fantasy’ to Cointelegraph.

He has doubted the stability of Bitcoin because it is not backed by any major currency, and has labelled it ‘the dark side of finance’ due to its links to illegal activities.

Saylor has made billions out of his ‘bitcoin treasury’, and he has seen his fortune skyrocket since Donald Trump was elected as the president launches his own cryptocurrency company

Chanos has built his reputation, and net worth of around $2 billion, on shorting companies, and most famously bet against Enron before the company’s accounting scandal in 2001.

When Chanos laid down his gamble against Saylor in May, he said MicroStrategy’s approach to cryptocurrency could lead other, less stable firms to follow suit, and ultimately lose money if he is correct.

He said his trade is ‘a good barometer of not only just the arbitrage itself, but I think of retail speculation’, per Cointelegraph.

Earlier this month, the feud between the two billionaires escalated as Saylor criticized Chanos on Bloomberg TV, warning that ‘if our stock rallies up, he’s going to get liquidated and wiped out.’

The next day, Bloomberg showed Saylor’s warning to Chanos, to which he responded: ‘I always love it when management says: ‘He just doesn’t understand our business.’

‘Michael Saylor is a wonderful salesman, but that’s what he is: He’s a salesman. … I call it financial gibberish.’