Share and Follow

For many years, Venezuelan leader Nicolás Maduro has managed to withstand numerous forecasts predicting his downfall. Despite facing sanctions, diplomatic isolation, and internal turmoil, he has remained steadfast. However, the Trump administration’s recent actions, which include seizing a Venezuelan crude oil tanker and imposing a blockade on sanctioned vessels, have targeted a critical vulnerability of Maduro’s regime: its oil trade.

Melissa Ford Maldonado, who serves as the director of the Western Hemisphere Initiative at the America First Policy Institute, highlighted the regime’s critical reliance on oil. She shared with Fox News Digital that while the timeline and eventual outcome are still unclear, the regime’s heavy dependence on oil revenue makes it particularly susceptible. “One thing is clear: the Maduro regime can’t sustain itself without oil revenue,” Ford Maldonado pointed out.

The U.S.’s aggressive stance has raised alarms among European allies. They have expressed concerns that such actions might destabilize the region and complicate efforts aimed at reaching a political solution in Venezuela. Nevertheless, Ford Maldonado asserts that the Trump administration’s strategy is effectively targeting the heart of Maduro’s power structure.

“What we’re observing now, with President Trump’s directive for a complete blockade on all sanctioned oil tankers entering and leaving Venezuela, is a strategic blow to Maduro’s revenue streams,” she emphasized. “He relies on the oil proceeds from these tankers to secure loyalty, compensate generals, cartel allies, and political enforcers to maintain his grip on power. That financial lifeline is being severed.”

Reports from Reuters indicate that approximately 11 million barrels of Venezuelan crude are currently stranded on 39 tankers anchored offshore. This situation underscores the significant impact of the blockade. (Planet Labs PBC/Handout via Reuters)

According to Reuters, up to 11 million barrels of Venezuelan crude are currently stranded aboard 39 tankers anchored offshore.

Jorge Jraissati, president of the Economic Inclusion Group, said the recent U.S. actions “fundamentally change the economics of Venezuela’s oil exports.

“That oil is neither sold nor paid for,” Jraissati said. “Until those cargoes move, they generate no cash flow for PDVSA and deepen Maduro’s liquidity strain.” PDVSA is Venezuela’s state-run oil company.

Venezuela is one of the most oil-dependent countries on Earth. Oil accounts for more than 80% of exports and roughly 90% of government revenue, leaving the nation extraordinarily exposed when crude shipments falter.

“After years of economic collapse as a result of Venezuela’s socialist policies, virtually all other sectors of the economy are bankrupted,” Jraissati noted.

A gas flare behind a coking coal pile at the Jose Antonio Anzotegui Petrochemical Complex in Barcelona, Venezuela, on May 22, 2023. (Carolina Cabral/Bloomberg/Getty Images)

U.S. sanctions on Venezuelan oil have been in place since 2019, but enforcement often lagged, and PDVSA continued to move crude through intermediaries and opaque trading networks, mainly toward Asia. The recent tanker seizure appears to have changed that dynamic.

The Trump administration said the seized vessel was headed for Cuba, but Jraissati argued China was the more likely destination. “Tankers of that size are typically deployed on long-haul routes, and China accounts for roughly 60% percent of Venezuela’s oil exports,” he said.

Not only has crude become harder to sell, it has become cheaper. Venezuelan heavy crude is trading at discounts of up to $21 per barrel below Brent, according to sources cited by Jraissati and confirmed by Reuters reporting.

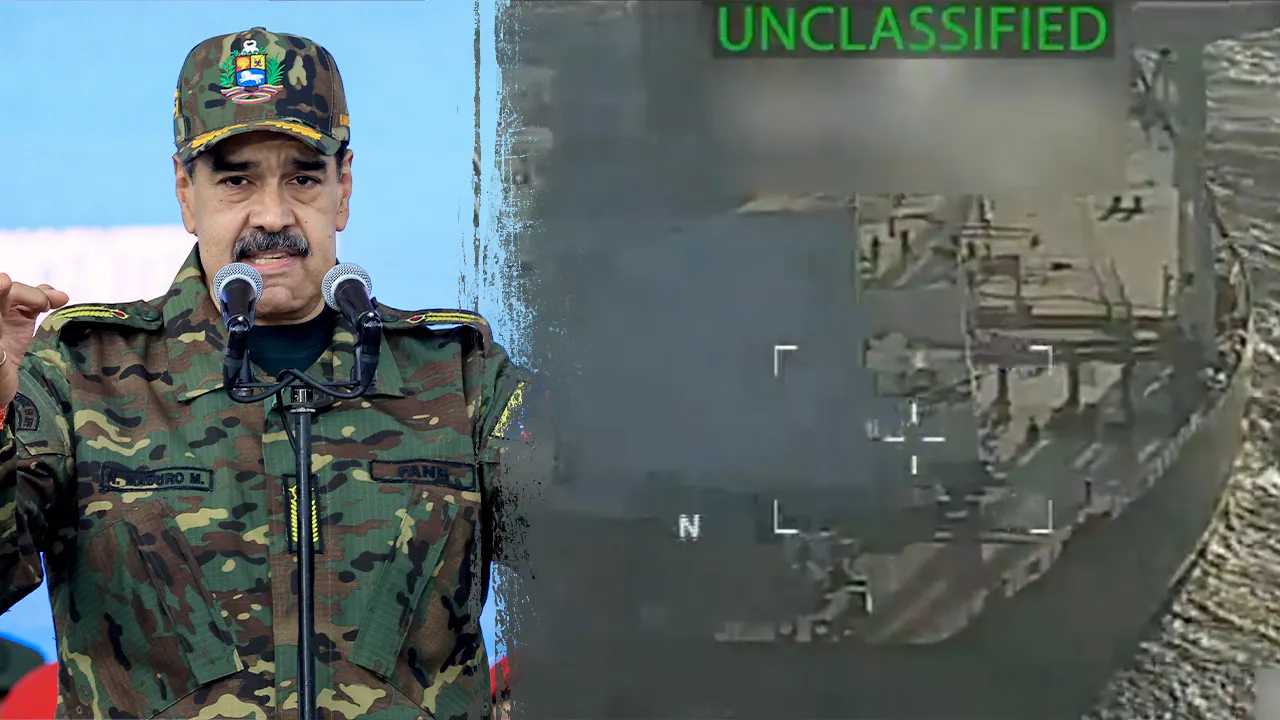

Newly released footage shows U.S. forces securing a Venezuelan oil tanker. (@AGPamBondi via X)

“The seizure is already reshaping Venezuela’s oil trade,” he said. “PDVSA is facing stuck cargoes, rising price discounts and new demands from buyers to renegotiate spot contracts.”

Oil tankers, with cargoes worth tens of millions of dollars, now face heightened risk if they enter Venezuelan waters. This has sent buyers and shipowners scrambling for insurance and new terms.

“In general terms, this is a game-changing policy because it fundamentally alters the economics of exporting oil from Venezuela,” Jraissati said. “Exports will not stop, but the conditions under which they are sold will deteriorate sharply. It will weaken Maduro’s cash flow.”

An oil tanker is seen anchored in Lake Maracaibo, Venezuela, after loading crude oil at the Bajo Grande Refinery port. (Jose Bula Urrutia/UCG/Universal Images Group/Getty Images)

For years, Venezuela has used a “shadow” or “dark” fleet — vessels that turn off tracking systems, swap names and switch flags — to move crude around sanctions. Jraissati said this network of ships tries to obscure ownership through shell companies and frequent reflagging.

Even these workarounds are under strain as insurers and ports become wary of vessels linked to Venezuelan crude.

U.S. forces were seen climbing staircases on the ship. (@AGPamBondi via X)

Jraissati painted a grim picture of Venezuelan society already unraveling under economic collapse.

“Eighty percent of people in Venezuela are in poverty,” he said. “Fifty percent are in extreme poverty, meaning they don’t make even $3 a day.”

He added that more than 30% of the population — around 8 million people — have left the country amid the ongoing crisis.

Jraissati cautioned that oil pressure alone will not topple Maduro, but described the current combination of sanctions, seizures and diplomatic isolation as unprecedented.

“This needs to be seen as a combination of actions. Oil pressure alone is not enough. Diplomatic pressure alone is not enough. But when all of these are combined, there is a much greater possibility of Maduro actually falling,” he said.

Cale Brown, chair of Polaris National Security and a former State Department principal deputy spokesperson, said authoritarian regimes often endure sanctions by shifting into illicit revenue streams.

Venezuela’s Nicolas Maduro greets his supporters during a rally in Caracas on Dec. 1, 2025. (Pedro Mattey/Anadolu via Getty Images)

“Regimes like Maduro’s display little concern about the impact of sanctions on their own people, and when traditional sources of income dry up, they seek other lifelines, as Maduro has with narcotics and other forms of illicit finance,” Brown said.

Still, Brown said Washington’s strategy reflects broader security concerns, drug and human trafficking and hostile foreign influence in the Western Hemisphere.

“President Trump is right to identify Venezuela as ground zero for many of the problems we are concerned with in the Western Hemisphere,” Brown said.

Maduro has survived sanctions, protests and isolation before. But analysts say the current oil crackdown directly threatens the regime’s ability to pay security forces, maintain patronage networks and keep the state functioning.

In this April 13, 2019, file photo, Nicolas Maduro, speaks in Caracas, Venezuela. (Ariana Cubillos/AP Photo)

“It’s very important that we continue to emphasize that Venezuela’s oil does not belong to Maduro or his cronies,” Ford Maldonado said, “It belongs to the Venezuelan people who made their choices clear at the ballot box last year and have been robbed blind by the regime which continues to enrich itself and hijack the country’s primary economic lifeline to stay in power. Cutting off that cash is the fastest way to weaken the regime, and weakening the regime helps the Venezuelan people!”