Share and Follow

As Republicans in Congress look for ways to slash spending, some legislators are floating new taxes on college scholarships, an end to student loan repayment plans and a big hike in taxes on university endowments.

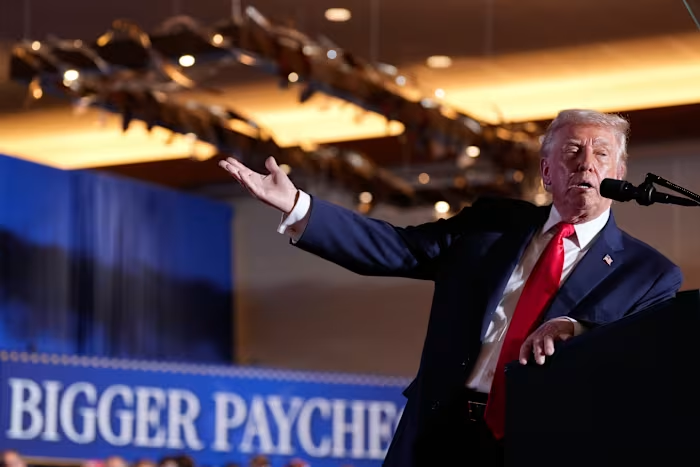

The ideas affecting higher education are among many in circulation among House committees that are exploring ways to cover the cost of extending and expanding tax cuts passed in President Donald Trump’s first term.

The recommendations are still evolving, and it’s unclear how close any of them will get to being implemented. Regardless, advocates across higher education say they are alarmed to see such proposals gain traction at all with Republicans.

“It’s shocking to me because this amount of cuts is not happening in reaction to like a budget crisis, like a recession. This really feels different in the sense that it is not something that there is an external push or a need for. So, it feels more ideological in a way,” said Jessica Thompson, a higher education policy expert with The Institute for College Access and Success.

Here is a look at possible federal budget cuts that would affect higher education under the Trump administration:

Cutting programs that help students pay off college debt

The U.S. House Committee on Education and the Workforce has suggested several possible ways to overhaul student loan programs. Some would reduce student access to federal aid for college.

On the chopping block potentially are several plans students can opt into to repay their students loans, including the SAVE plan introduced by the Biden administration. That plan doesn’t require borrowers to make payments if they earn less than 225% of the federal poverty line — $32,800 a year for a single person — and prevents interest from adding to balances as long as borrowers make their monthly payments. The SAVE plan was already put on hold after Republicans challenged it. Some plans do not appear to be targeted, including one that caps loan payments based on borrowers’ income level.

Another possible change would give borrowers additional opportunities to recover from defaults. While they currently can rehabilitate their loans just once, allowing them to make a certain number of consecutive payments to get out of default, the proposal would allow them to go through that process twice. The committee projected the new process could save the government millions of dollars but did not spell out how.

The timing is uncertain on when any of these proposals could surface. They could be considered as soon as this spring in a process known as budget reconciliation that would allow Republicans to squeeze proposals through Congress purely on party-line votes. That would not be easy in the House, where Republicans hold the majority by just a few seats.

An end to tax-free status for scholarships

Scholarships and fellowships have been exempt from taxes as long as they are used for tuition and related expenses. That would change under another proposal that’s up for consideration.

The changes could create new financial burdens for students and families, advocates say.

“There’s been great progress in bringing down the costs of higher education. Adjusted for inflation, public university tuition is less now than it was ten years ago,” said Craig Lindwarm, senior vice president of governmental affairs with the Association of Public and Land-Grant Universities. “But as we look at some of the proposals that are options, many would increase costs on students and families, and I think (the proposals) are heading in the direction that most don’t want to see, which is increasing expenses on students and families.”

Increasing taxes on college endowments

The Tax Cuts and Jobs Act currently requires some private nonprofit colleges and universities to pay a 1.4% tax on income from their endowments, which raised about $244 million from 58 institutions in 2022. The committee suggests increasing that to a 14% tax and expanding which colleges would have to pay it.

Also being considered among hundreds of other ideas in circulation are fines for colleges and universities that violate students’ rights under Title VI of the Civil Rights Act, which protects against discrimination toward students of shared ancestry. Such investigations often have been resolved through settlements calling for training and policy updates. Title VI is currently what is being used to investigate complaints of antisemitism on college campuses across the U.S.

___

Mumphrey reported from Phoenix. AP education writer Collin Binkley in Washington, D.C., contributed to this report.

___

The Associated Press’ education coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.