Share and Follow

Key events

Banking expert says NatWest boss’s future depends on how much she knew about Farage matter

The Farage affair rumbles on. Yesterday, the head of NatWest apologised to Nigel Farage for what she called “deeply inappropriate comments” about the former Ukip leader in an internal report that led to the closure of his accounts at the group’s exclusive private bank, Coutts.

Dame Alison Rose issued a public statement and wrote a letter to Farage apologising for the way the NatWest subsidiary had handled its decision to cut ties with the Brexit campaigner.

Philip Auger, a former TSB board member who has written about the world of banking, said the big question is how much Rose knew, and when – whether she was briefed about this or whether the decision was taken at a lower level. He told BBC radio 4’s Today programme:

I don’t think it can end with this apology… It may not end for chief executive Alison Rose, in particular, and for the banking industry. You can’t have what is essentially a kind of a fundamental utility type industry deciding who will say what and who’s free to give political opinions and who isn’t. It kind of strikes at the core of democracy and I don’t think it can end here now.

I mean, the big issue really is what Alison Rose knew about this, was this decision to de-bank Farage actually run by her personally, was she briefed about it, or was it taken at a lower level?

Responding to the suggestion that she could lose her job over the matter, Auger said:

It depends entirely on on how much she knew, and when. And the regulator, the Financial Conduct Authority, will be quite interested in the briefing that went on before the full story broke.

Alison Rose’s mantra has always been inclusive. Inclusivity is at the heart of our organisation.

Auger also noted that she “has done a pretty stunning job at turning that NatWest round”. The bank is still 38% owned by the taxpayer following its bailout during the financial crisis when it was known as Royal Bank of Scotland.

Divya Sridhar, economist at PwC, said:

The latest inflation data provided some hope for public finances. CPI inflation fell to 7.9% in June, compared to 8.7% in the previous month.

Looking ahead, lower inflation should help ease government spending pressures driven by debt interest payments and inflation-linked benefits. In addition, the fall in Ofgem’s energy price cap for July to September 2023 will bring household energy prices below the government’s Energy Price Guarantee, providing further relief to public spending.

However, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, takes a gloomier view.

Good news on recent levels of public borrowing will not be celebrated much at the Treasury, given that the outlook for debt interest payments has deteriorated substantially since the budget.

We continue to think that the chancellor will not have scope to cut taxes meaningfully before the next general election, which must be held by January 2025.

Government debt pile bigger than UK economic output in June

The public finances were less rosy.

The government’s debt pile was bigger than the UK’s economic output in June – the first time this has happened for more than 60 years.

The chancellor, Jeremy Hunt, vowed to maintain fiscal discipline:

Now more than ever we need to maintain discipline with the public finances.

We are at a crucial juncture and need to avoid reckless spending. As this week’s fall in inflation showed, we will start to see results if we stick to our plan to halve inflation, grow the economy and get debt falling.

The strong rise in June retail sales points to economic growth in the April to June quarter, some economists say.

Martin Beck, chief economic advisor to the EY Item Club, said:

Retailers’ better performance in the second quarter increases the likelihood that the economy managed to grow in the quarter, despite headwinds from May’s extra bank holiday and ongoing industrial action. But the sector will likely face significant challenges with holding onto its recent strength. So far, the impact of rising interest rates has been modest, reflecting the high share of fixed-rate mortgages and a pick-up in interest income for savers. But a rising number of households are reaching the end of fixed-rate deals and those re-mortgaging in the second half of this year typically face a rise in monthly mortgage payments of several hundred pounds.

Meanwhile, households’ spending power remains under pressure from still-high inflation. And these headwinds appear to be finally affecting consumer confidence – the GfK measure slid in June, the first fall since January.

That said, pressure from inflation is becoming less significant, as June’s fall in Consumer Price Index (CPI) inflation demonstrated… So, a difficult outlook for retailers, but with some sources of hope.

And Simon French, chief economist at Panmure Gordon, tweeted:

17-month low in UK inflation in retail sales at +0.2% MoM; +6.0% YoY. Together with a +0.7% volume growth in total sales this tees up June’s GDP figure (alongside a post-KC3 Coronation rebound) to return to growth. pic.twitter.com/BD2WINpyjt

— Simon French (@shjfrench) July 21, 2023

Other experts are more (cautiously) upbeat.

Helen Dickinson, chief executive of the British Retail Consortium, said:

Read Related Also: 'S–tshow': Scientists Downplayed Lab Leak Theory re: COVID Origins for Fear of China's Reaction if Blamed

June’s sunshine gave retail sales growth a boost as customers readied themselves for the summer season, with products in areas such as fashion, skincare and books performing particularly well. Nonetheless, consumer confidence remains fragile, and with households feeling the pinch from high inflation and rising interest rates they held back on making big ticket purchases, especially in areas such as electricals.

Retailers are hopeful that consumer confidence will improve over the coming months as inflation eases. Falling inflation rates are a clear sign that competition is bringing down prices wherever cost pressures ease. While retailers are doing their bit, government has a role to play in bringing inflation down.

The costly reforms to the packaging levy (Extended Producer Responsibility) and a new deposit return scheme could together add £4bn in costs to retailers, putting renewed pressure on prices. Government should reconsider the timelines for these interventions in order to not make the current challenging environment even more challenging for households and businesses.

Is this the last hurrah? asks Jonathan Moyes, head of investment research at Wealth Club.

Retail sales in June came in much stronger than expected, this is despite fears of soaring mortgage costs and stubborn inflation dominating the news flow over the month. I am reminded of a well-known quote describing economics “if you are not a little confused, you don’t understand it”.

It appears that warm weather drove consumers onto the high street in search of new clothing and garden furniture over the month. Whilst the picture may look rosy now, as the months grow colder, there is a risk the chill of higher mortgage costs and inflation will weigh heavy on household budgets.

The big question is how much longer can the consumer hold out? Is this the last hurrah of summer spending before the cost of living squeeze really begins to really bite, or is the consumer in a stronger financial position than many predict?

For now, the UK consumer continues to defy the doom mongers.

Kelly Miely, retail partner at Deloitte, said:

The hottest June on record painted a sunny picture for retailers as sales lifted for the third consecutive month. Spending on clothing and furniture rose as consumers devoted a larger share of their wallet towards discretionary items, as we’ve also seen in our latest Consumer Tracker.

Even as inflation begins to fall, the changing economic landscape is not immediately influencing consumer behaviours. Many consumers continue to source cheaper products through discounting and value-ranges, as well as opting to shop at budget stores. Mid-market brands and retailers will therefore need to show the value and quality of their product ranges to encourage spending.

“Sales boosted by sunny weather, but that may be as bright as it gets” – that’s the verdict from Ashley Webb, UK economist at Capital Economics. He thinks that as the full impact of interest rate hikes feeds through, the economy will still tip into recession in the coming months.

The further increase in retail sales volumes in June suggests the recent resilience in economic activity hasn’t yet faded. But our view that interest rates will rise further, from 5% now to a peak of 5.50%, suggest that it’s too soon to conclude that the rebound in retail sales will be sustained and that the economy will avoid a recession…

Looking ahead, the GfK measure of consumer confidence fell for the first time since January from -24 in June to -30 in July…

With the full drag on activity from higher interest rates yet to be felt, we still think the economy will tip into recession in the second half of this year and real consumer spending will fall by 0.5% from its peak to its trough.

Introduction: Hot weather helps lift retail sales; UK government borrowing falls

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

We’ve woken up to news that retail sales across Britain rose more strongly than expected in June, boosted by sizzling temperatures (it was the hottest June on record) and supermarket promotions.

Sales volumes climbed 0.7% month on month, while May’s rise was revised lower to 0.1% from 0.3%, according to the Office for National Statistics. The June figure exceeded economists’ expectations of a 0.2% monthly gain.

Food sales bounced back with 0.7% growth following a 0.4% drop in May, with some supermarkets saying that the good weather and promotions helped sales.

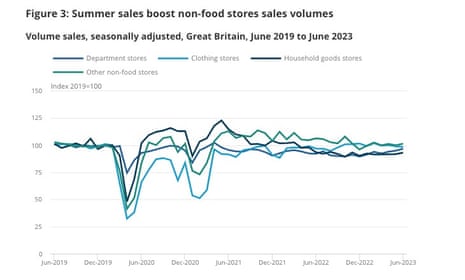

Sales were strong at most retailers with the exception of garden centres, clothes shops and petrol retailers. Department stores and furniture retailers also had a good month as the summer sales started, which brought in more customers.

ONS chief economist Grant Fitzner said:

Retail sales grew strongly, with food sales bouncing back from the effects of the extra Bank Holiday, partly helped by good weather, and department stores and furniture shops also having a strong month.

However, these were partially offset by falls in fuel, garden centres and clothes shops.

Separate official figures showed that the UK government borrowed £18.5bn last month, £400m less than a year earlier but the third-highest June borrowing since monthly records began in 1993. Higher tax receipts and a substantial fall in debt interest payable compared with June 2022 were largely offset by increased benefit payments and other costs.

Public sector net borrowing (excluding public sector banks) was £18.5 billion.

This is £0.4 billion less than in June 2022 and the third-highest June borrowing since monthly records began in 1993.

➡️ https://t.co/KpXBo6WdEW pic.twitter.com/UiFf36nbyW

— Office for National Statistics (ONS) (@ONS) July 21, 2023

Public sector debt excluding public sector banks was £2,596.2 billion at the end of June 2023, provisionally estimated at around 100.8% of the UK’s annual gross domestic product, continuing at levels last seen in the early 1960s. pic.twitter.com/G1AI48o5lf

— Office for National Statistics (ONS) (@ONS) July 21, 2023