Share and Follow

Florida taxpayers can soon benefit from a tax credit of up to $1,700 for donations to Scholarship Granting Organizations (SGOs), thanks to a new initiative aimed at expanding educational opportunities in the state.

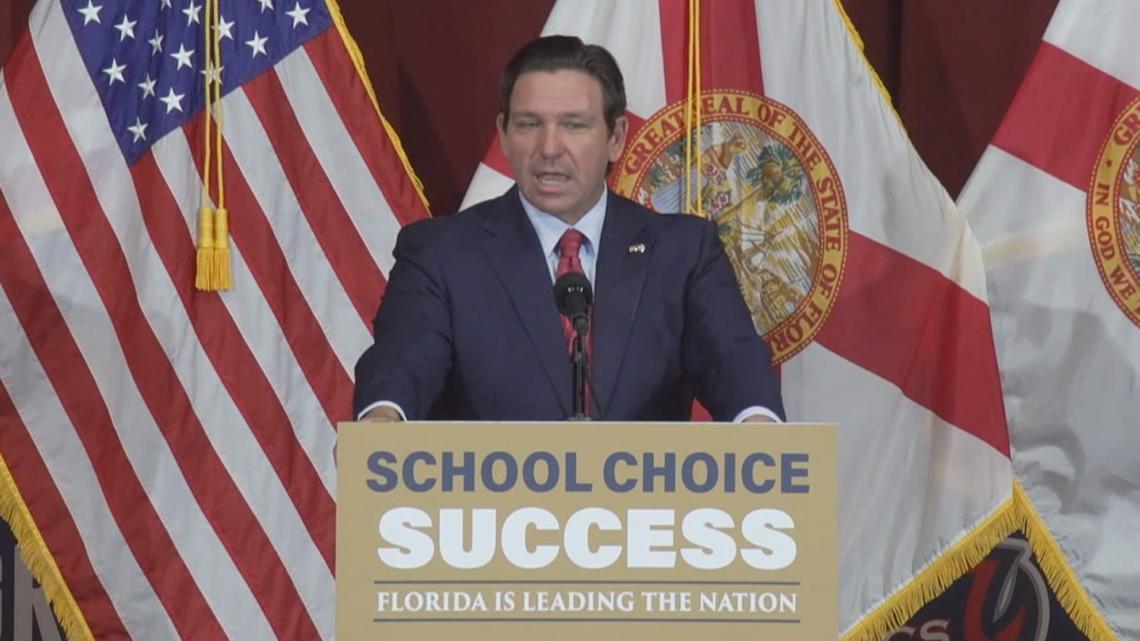

VALRICO, Fla. — In a move to broaden school choice for Florida families, Governor Ron DeSantis announced an expansion of funding aimed at enhancing educational options during a press conference held at Grace Christian School in Valrico on Wednesday morning.

Governor DeSantis revealed that Florida will participate in the “Federal Education Freedom” tax credit program, set to roll out in January 2027. This initiative allows taxpayers to redirect up to $1,700 of their federal income taxes to SGOs.

The “Federal Education Freedom” tax credit was introduced as part of the One Big Beautiful Bill Act, which passed in July. It is designed to empower families by offering scholarships that enable students to attend schools of their choice or access a variety of educational services and products.

The funds provide scholarships to children to attend a school of their choice or to access other education-related services and products.

DeSantis says the choice to opt Florida into the tax credit is consistent with the state’s initiatives to expand school choice for families. Some of which include increasing the annual scholarship cap for certain programs, and vouchers that cover roughly $8,000 private school tuition.

“It gives parents more resources, more options,” he said. “I think this could be something that’s really meaningful. I think it will supplement the great stuff we’re already doing here.”

“We are providing choice for families and we are empowering parents here in the state of Florida,” Florida Education Commissioner Anastasios Kamoutsas said during the presser. “The more we are able to fund these families, the more it seems like a likely opportunity for their child to benefit from school choice.”

Florida joins 23 other states opting into the Education Freedom Tax Credit.