Share and Follow

The Department of Justice says Phillip Mak attempted to shield his assets from the IRS by transferring $1 million in cash to his domestic partner’s bank accounts.

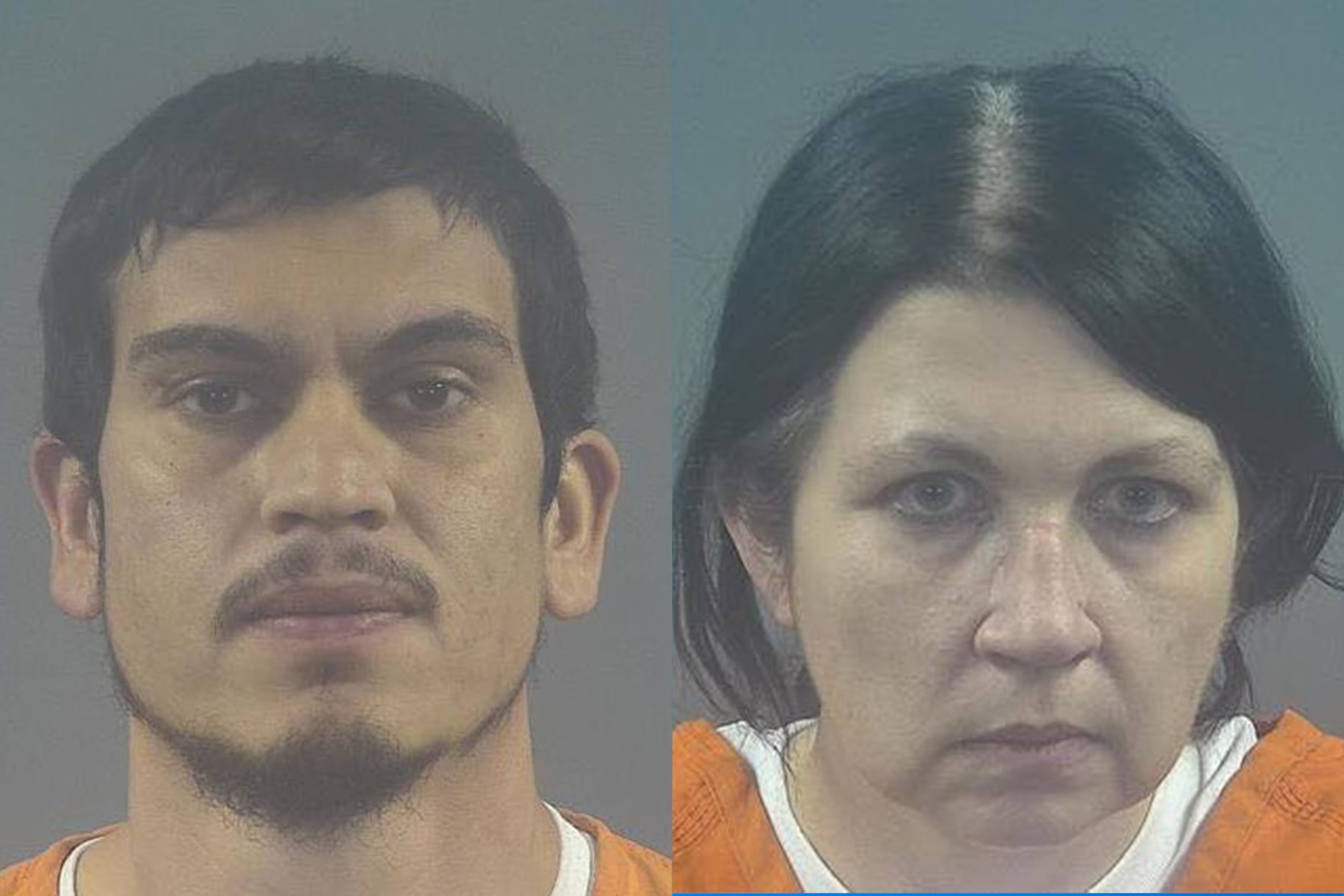

JACKSONVILLE, Fla. — A federal grand jury in Jacksonville indicted a Florida businessman with “tax evasion, not filing a tax return and not paying taxes” on Wednesday, the Department of Justice (DOJ) said in a press release Thursday.

The DOJ’s release says according to the indictment, Phillip Mak of Jacksonville was a self-employed businessman who from 2008 through 2020, earned approximately $10.3 million in income.

“During that same period, Mak allegedly did not pay any federal taxes and, except for two years, did not file tax returns,” the release states. “The IRS allegedly assessed approximately $1.9 million in outstanding taxes, penalties and interest against Mak for tax years 2008, 2009, 2012-2015 and 2019-2020.”

Mak allegedly attempted to shield his assets from the IRS by transferring $1 million in cash to his domestic partner’s bank accounts “instead of paying what he owed,” according to the release. Additionally, the DOJ says the indictment alleges that after being interviewed by IRS investigators, Mak transferred ownership of his home to his domestic partner’s trust, created a nominee entity and began depositing his income into a bank account held in the name of that entity.

In total, Mak is accused of having caused a tax loss to the IRS of more than $1.92 million, the DOJ said. If convicted, he faces a maximum sentence of five years in prison for tax evasion and a maximum sentence of one year in prison for each charge of failure to file a tax return and failure to pay tax.

“A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors,” the release states.

The DOJ said the IRS Criminal Investigation is investigating the case, and that trial attorneys Isaiah Boyd and Michael Jones of the IRS’ Tax Division, as well as Assistant U.S. Attorney John Cannizzaro for the Middle District of Florida are prosecuting the case.